President Trump signed a major new tax and spending law – One Big Beautiful Bill Act or OBBBA – on July 4, 2025. This law is very large – approximately 900 pages – and makes big changes to how taxes work in the U.S.

I‘d like to help sort through what the new OBBBA tax law means for you, your family, and your financial planning. Firstly, this new law will affect your household budget right away as taxes play a big role in financial planning. Secondly, many investors are also concerned about how much the government spends (deficit), the growing amount the government owes (debt).

Key Takeaways

- There are many Financial Planning implications with the new OBBBA tax law changes.

- Many of the 2017 Tax Cut and Jobs Act provisions are now permanent.

- Some changes to the old provisions such as restrictions on Medicare and SNAP benefits, increase in the child tax credit, SALT cap changes, and charitable contribution changes.

- Many NEW provisions including a “Senior Bonus,” Trump accounts, no tax on tips or overtime (restrictions), increased standard deductions, plus much more

- The U.S. debt ceiling is rising by $5 trillion over the next 10 years

As you would expect, there are many complexities in this new budget law. I will break down some key points in these 4 categories:

- What’s in the New Tax Law

- The Bigger Picture: Government Deficit and Debt

- Why this Matters for your Financial Planning

- Actions to Consider

Please note these highlights are intended for awareness and educational purposes only of a very lengthy and complex tax bill. See your financial or tax professional for details and how these may apply to your specific situation.

1. What’s in the New Tax Law

The new law keeps and expands many tax rules from the 2017 Tax Cuts and Jobs Act (TCJA) that were going to end. It also incorporates some new provisions. Here are the main changes:

TCJA Extensions and Amendments

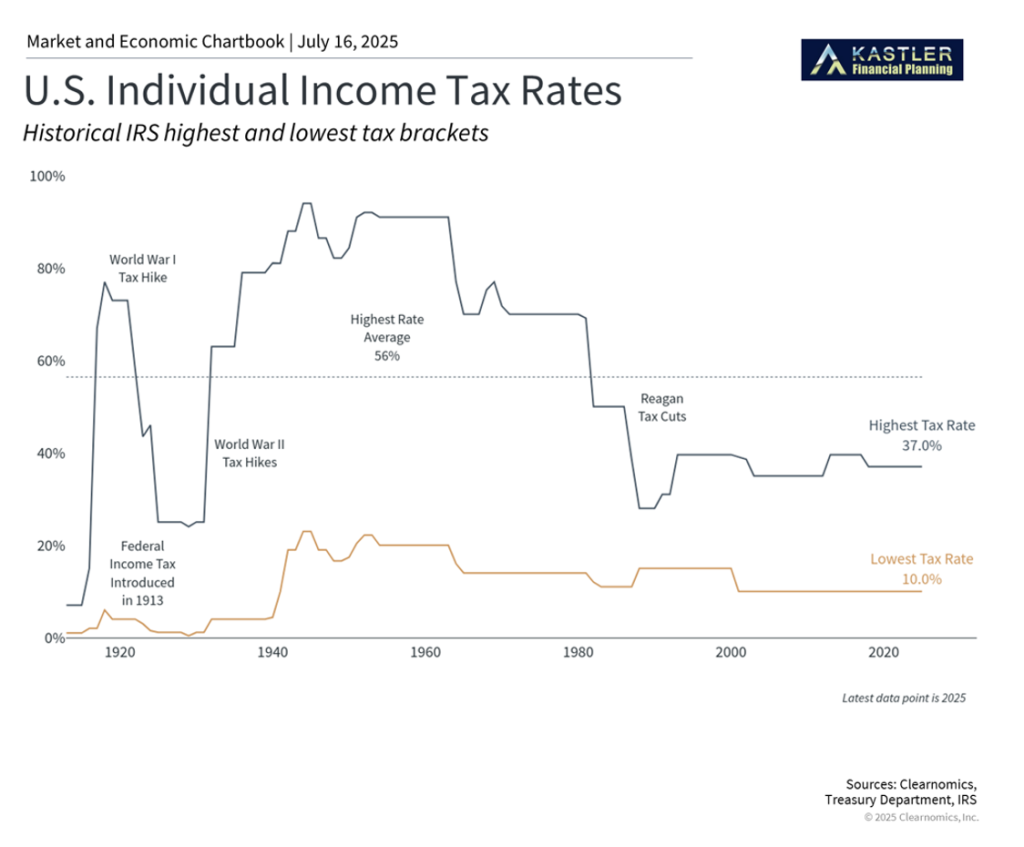

- Current tax rates and brackets from 2017 are now permanent, giving you long-term certainty. Before, they were going to expire at the end of 2025.

- The 10% and 12% brackets will receive an extra inflation adjustment in 2026

- The standard deduction goes up to $15,750 for single people, $23,625 for Head of Household, and $31,500 for married couples filing jointly.

- SALT cap increased – The limit on state and local tax deductions goes up a lot – from $10,000 to $40,000. This limit will grow by 1% each year through 2029, then go back to $10,000 in 2030. Although, there are income phasedowns to be aware of.

- Charitable contributions (for itemizers) – starting in 2026, a 0.5% of AGI is used as a ‘floor.’ Contributions must exceed the floor to be deductible.

- Sec. 199A deduction – Deduction made permanent (20% of QBI). Phaseout thresholds remain. Many other details apply.

- Alternative Minimum Tax – AMT exemption remains $88,100 (S, HoH) and $137,000 (MFJ). Exemption phaseout thresholds lowered to $500,000 (S, HoH) and $1m (MFJ) of AMT income. Other details apply.

- Many other TCJA provisions extended

New Tax Law Provisions

- Seniors (age 65+) get an additional $6,000 deduction (per person) through 2028. There are nuances and income limits to be aware of:

- This is a below-the-line deduction and available to non-itemizers

- Does not reduce AGI, Social Security taxation and Medicare premiums are not affected

- Phases out between AGI of $75k – $175k (S or HoH) or $150-$250k (MFJ)

- The child tax credit goes up from $2,000 to $2,200 per child, with future increases based on inflation. Credit phaseouts extended.

- Charitable contributions (for non-itemizers) – $1,000 (S, HoH) or $2,000 (MFJ)

- Below-the-line deduction (only available to non-itemizers)

- Available 2025-2028

- Not subject to 0.5% floor (floor is only for itemized charitable contributions)

- Contributions must be in cash

- Can be for public or private charities

- Cannot be for 509(a)(3) and cannot be used to establish or maintain a Donor Advised Fund

- No tax on tips – Below-the-line deduction (available to non-itemizers) from 2025-2028

- $25,000 maximum deduction

- Deduction is reduced by $100 per $1,000 of income above $150,000 (S, HoH) or $300,000 (MFJ) of AGI

- Tips must not be earned through a Specified Service Trade or Business (SSTB)

- Still subject to payroll tax, included in AGI, and potentially subject to state tax

- No tax on overtime – Below-the-line deduction (available to non-itemizers) from 2025-2028

- Max deduction: $12,500 (S, HoH) or $25,000 (MFJ)

- Deduction is reduced $100 per $1,000 of income above $150,000 (S, HoH) or $300,000 (MFJ) of AGI

- Only covers overtime earnings in excess of normal wage rate

- Still subject to payroll tax, included in AGI, and potentially subject to state tax

- Auto loan interest deduction – below-the-line deduction (available to non-itemizers) from 2025-2028 on NEW loans taken out or refinanced after 12/31/2024

- Up to $10,000 of “qualified passenger vehicle loan interest”

- Vehicle must be assembled in USA

- Phased out for MAGI $100k-$149k (S, HoH) or $200k – $249k (MFJ)

- New Qualified 529 Expenses

- Expanded K-12 expenses (in addition to tuition)

- Public, private, or homeschool expenses: $20k/year aggregate limit

- Postsecondary credential expenses (including tuition)

- Must be industry recognized or accredited by a major credentialing organization, or recognized by US government

- Expanded K-12 expenses (in addition to tuition)

- Trump Accounts –

- Federal government offering a $1,000 Trump Account contribution for every US citizen born from 2025-2028 (one-time contribution)SSN required for childMust opt-inRules prior to the year the beneficiary turns 18:

- $5k/year individual contribution allowed (indexed to inflation)

- $2,500/year employer contribution allowed (counts toward $5k limit)

- Non-deductible

- No distributions allowed before the year the beneficiary turns 18

- Investments limited to funds that track a U.S. equity index; cannot use leverage; no feels larger than 0.1%/year

- Rules beginning the year the beneficiary turns 18:

- Early withdrawal penalty applies before age 59 ½

- RMDs and 10-year withdrawal rule will likely apply

- Federal government offering a $1,000 Trump Account contribution for every US citizen born from 2025-2028 (one-time contribution)SSN required for childMust opt-inRules prior to the year the beneficiary turns 18:

Other Important Changes

- Some green energy tax credits are removed

- Estate tax exemptions (how much you can pass to heirs without taxes) will stay high, going up to $15 million for individuals and $30 million for couples in 2026

2. The Bigger Picture: Government Deficit and Debt

While the tax changes are good for many families, they do come with broader economic concerns. The Congressional Budget Office estimates this law will add over $3 trillion to the national debt over the next ten years. The federal debt already totals $36.2 trillion, or around $106,000 for every American.

This situation isn’t new – government borrowing has grown consistently for decades. To put this in perspective, the last time the federal budget was balanced (spending equaled income) was 25 years ago. This happens because most government spending goes to programs like Social Security, Medicare, defense, and interest payments on existing debt, which are hard to reduce politically.

From an investment perspective, higher debt levels can affect interest rates and inflation over time. However, many of the worst-case scenarios that investors worry about haven’t happened. The key is keeping a diversified portfolio (spreading investments across different asset types) that may help your portfolio perform better in different economic situations.

3. Why This Matters for Your Financial Planning

This law removes what many called the “tax cliff” – a situation where tax rates could have gone up a lot if the previous rules had expired. By avoiding the “tax cliff” and providing a degree of certainty, we can now make better long-term financial plans for you and your family.

The law keeps the relatively low tax environment we’ve had in recent decades. Looking back at history, current tax rates are still much lower than the highest rates of the 1900s, when top rates sometimes went over 90% during wartime.

For estate planning (planning how to pass money tax-efficiently to your family), the higher exemption limits mean fewer families will pay federal estate taxes. However, it’s still important to have a complete plan for passing assets to future generations, especially since some states have their own estate taxes with lower limits.

4. Your Investment Strategy Moving Forward

While tax policy changes can affect your personal financial situation, they usually have limited impact on long-term investment opportunities. Markets have historically grown regardless of tax policy changes, and the economy has shown strength across different fiscal environments.

The main point is that this law extends the current low-tax environment and provides more certainty for planning. While there are broader concerns about government debt, this shouldn’t change your investment approach. A well-built, diversified portfolio designed to handle various economic conditions remains the best way to build wealth over time.

Here are a few important Planning recommendations:

- When planning for Roth Conversions, be sure to note the phase out ranges for certain deductions and credits. (Roth Conversions add to your taxable income).

- How much each of these tax law provisions impact you will vary greatly from individual to individual depending on your specific situation. Use qualified professionals and tools.

- See your financial professional to determine how the OBBBA provisions apply to your specific situation

Please keep in mind, when we say a tax law has been made “permanent”, that means the law is no longer set to expire. In other words, “permanent until the next tax law is passed.”

We’ll keep watching how these changes develop and their impact on your financial planning. As always, please don’t hesitate to reach out with any questions. And if you need financial planning or retirement planning services, we can provide that on a fee-only, fiduciary basis.

How We Can Help

Our goal is to help you achieve your Purposeful RetirementTM. Income Planning, Tax Planning, and Investment Planning are the 3 key pillars to our 7 Pillars Retirement Planning® approach. Health, Long-Term Care, Risk Analysis, and Estate Planning round out the 7 pillars we can help you with to prepare your personalized retirement plan.

Mike Kastler has been performing financial planning and retirement planning since 2015. He has a Master of Science in Finance and the prestigious designation Retirement Income Certified Professional®. As a Fee-Only, Fiduciary, and Independent professional it is a client-first/planning-first approach. No commissionable products are sold and Assets Under Management (AUM) services are provided as a flat-fee service, not a % of AUM. More About Us here: KastlerFinancialPlanning.com/about

We Help You Visualize Your Retirement Possibilities

Article References

Clearnomics article “What Does the New Tax Bill Mean for my Family?”, July 16, 2025, https://app.clearnomics.com

Continuing Education course through Kitces.com, July 22, 2025