Retirement isn't a One-Time Event - it's a Journey

On-Going Support Service

Why On-going Support Matters

Life changes. Markets shift. Your goals may evolve. That's why your Retirement Plan deserves regular attention.

At Kastler Financial Planning, we offer a service for On-Going Support - designed to keep your Retirement Plan aligned with your life circumstances. If you've been discouraged by high fees, poor communication, or generic reports in the past, you'll appreciate our refreshingly personal approach.

A Retirement Plan is only as strong as its implementation. Studies show that regular updates and accountability are key to long-term success.

At Kastler Financial Planning, we offer a service for On-Going Support - designed to keep your Retirement Plan aligned with your life circumstances. If you've been discouraged by high fees, poor communication, or generic reports in the past, you'll appreciate our refreshingly personal approach.

A Retirement Plan is only as strong as its implementation. Studies show that regular updates and accountability are key to long-term success.

Retirement Plan Implementation

Once your Initial Retirement Plan has been created, we can help you implement the Plan. Included services:

- Transfer investable assets to custodian Charles Schwab

- Invest your assets according to the portfolio design in your Retirement Plan

Why Charles Schwab?

We've chosen Schwab for its reliability, transparency, and investor-friendly platform. You'll benefit from:

- No-cost trading on a wide range of funds and ETFs

- Convenient virtual onboarding

- You maintain direct control with secure account access

- Advisor-led rebalancing and service - no call centers

On-going Retirement Plan Reviews

Prefer to manage your own investments? We'll serve as your strategic partner - providing expert analysis and quarterly guidance to keep your Initial Plan up to date. Included services:

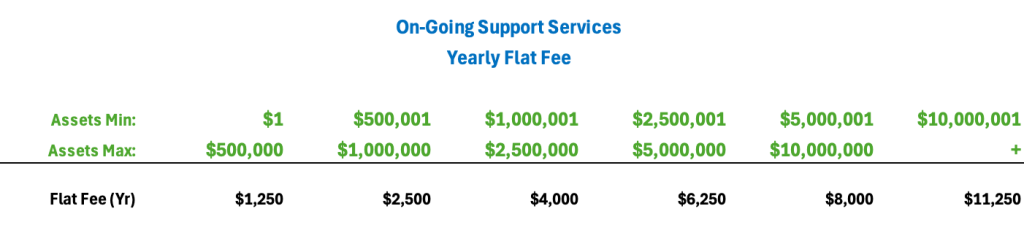

- Low-cost, Flat-fee, tiered Retirement Planning and Advice

- Quarterly Retirement Plan Snapshot

- Quarterly conversations based on your personalized Client Service Calendar

- Annual Retirement Plan Update

- 24/7 access to all your information via secure client portal

We provide the analysis, insights, and recommendations for your changing retirement circumstances.

Quarterly Retirement Plan Snapshots

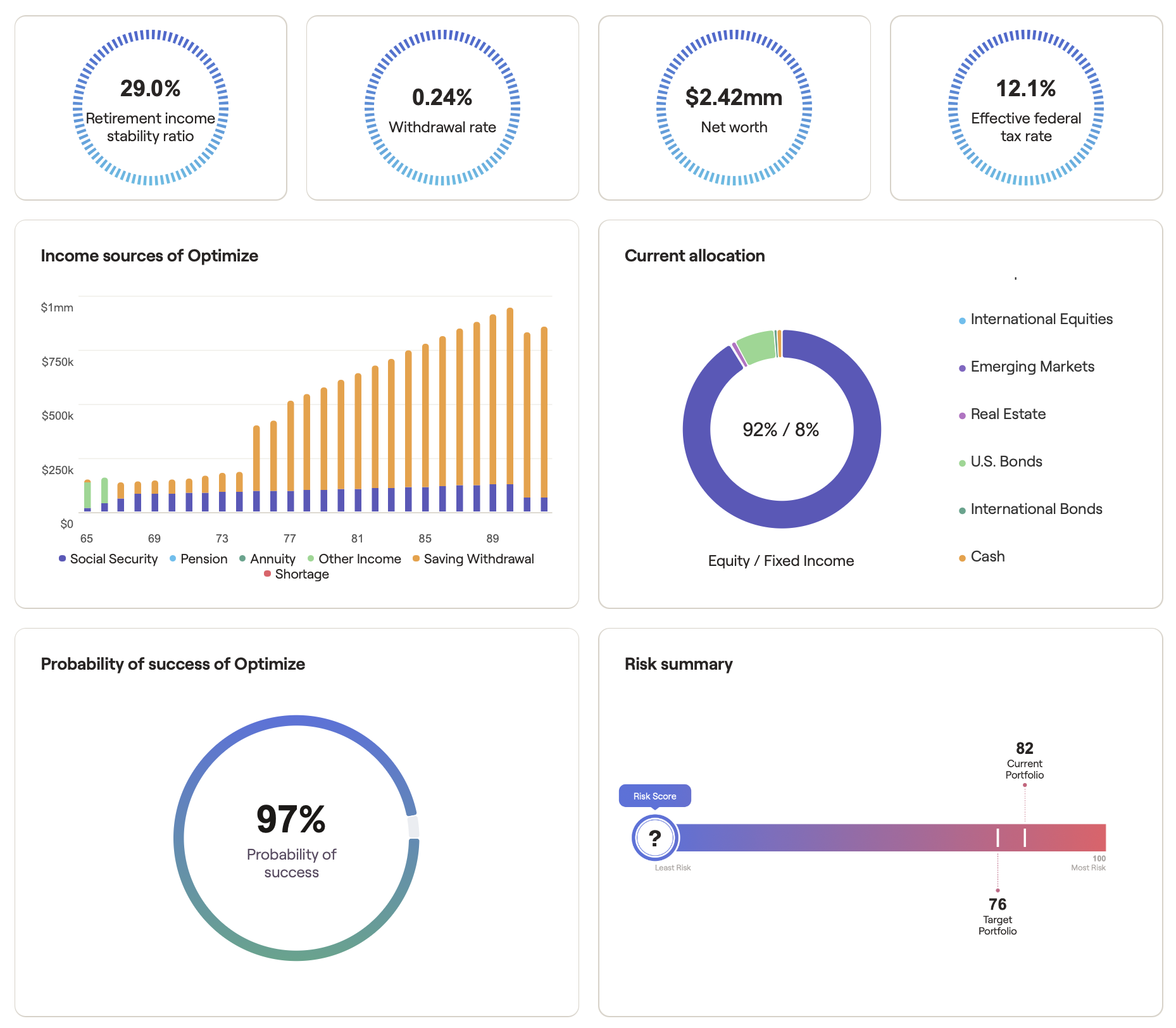

We go beyond standard investment statements - tying your portfolio directly to your Retirement Plan goals and strategy. Together, at a glance, we'll be able to track your progress and detect areas that may need adjustment. We will cover a number of metrics:

- Your projected Retirement Income ratio and the sources providing that income

- Expected withdrawal rate from your portfolio

- Probability of success

- How your portfolio risk aligns with your Risk Tolerance

Example quarterly snapshot:

Quarterly Conversations

We are a boutique firm, intentionally limiting our client load to ensure meaningful conversational engagement with you. Each quarter, we will perform the following:

- Review life changes and the impact on your Retirement Plan

- Discuss your Retirement Snapshot

- Review the "Observations, Risks, and Recommendations" from your Initial Plan

- Highlight a key section of your Plan for deeper insight

Annual Rebalancing

Each year, we revisit your Retirement Plan projections, risk tolerance, and investment asset mix. We will then rebalance your portfolio as needed. We will also update your "Observations, Risks, and Recommendations" summary to reflect any changes, ensuring your Retirement Plan remains relevant to your current situation.

Transparent, Low-Cost Flat-Fee Structure

Our tiered flat-fee structure includes both Planning fees and Advisory Investment Management fees. We think you will find these to be among the lowest in the industry, and always delivered by a qualified fiduciary professional. The tiered pricing structure reflects the general complexity of your Plan.

No commissions. No referral fees. Just qualified advice and on-going support

No commissions. No referral fees. Just qualified advice and on-going support

Bottom Line

Our low-cost, flat-fee, tiered pricing is among the most competitive in the industry, especially when paired with our flagship Retirement Planning services. It's a powerful combination:

Retirement Planning + On-Going Support Services = Your Purposeful Retirement™

Ready to Get Started?

Let's explore your goals and see if we're a good fit. Whether you are looking for advice-only Planning or full-service investment management, we'll meet you where you are and help you move forward with purpose.

Set Up a

no-charge Consultation!

Contact Us TodayIf you believe you could benefit from working with a fiduciary financial professional, let’s review yours goals to see if you’re a good match for our practice or if you have any questions, you can ask here!