Retirement Investment Planning can be quite challenging In today’s volatile market. It’s common to ask the question, “Are my investments going to be okay if I want to retire in the next 5 years?” Or if you’re in the first couple of years of retirement and concerned about withdrawing money, your concerns are certainly understandable.

However, history has shown us that as markets go through periods of volatility, they also recover. For example, during the 2008 financial crisis, markets dropped sharply, but many who stuck to their long-term strategy also saw significant rebounds over the following years. The same was true after events like the Dot-Com Bubble and even the sharp decline at the start of the pandemic in 2020. Through all these times, patience and disciplined investors have been rewarded.

I’d like to offer some perspective to these market events with some helpful historical charts. Then I will offer up my investment philosophy in retirement planning and some ways to mitigate the current environment. You may read on to explore these topics or if you would prefer to schedule a 30-min no-cost/no-obligation meeting to discuss your specific concerns, you may do so here:

Historical Market Perspectives

The first 3 charts below show:

- The value of time in the market (versus timing the market)

- Correction recovery averages

- Bear market recovery average

If you are a long-term investor, these 1st 3 graphics may bring you some comforting news.

Time in the Market vs Timing the Market

Trying to time the market can hurt you. How? Well, 2 ways: you can error on when you sell, and you can error on when to get back in. Simply put, you may miss out on some of the best days of market returns during the bear market.

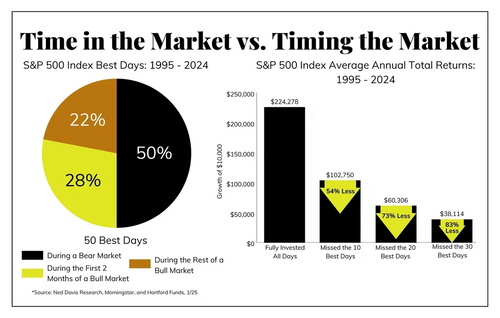

This chart below shows that 50% of the best market return days occur during a bear market (the pie chart). The adjacent bar chart shows the financial impact of missing just 10, 20, or 30 days of those best days, had you tried to time the market.

Most investors know that short-term timing the market is a bad idea. The chart shows the value of “Time in the Market vs Timing the Market”.1 The bottom line is to make sure you have a well-constructed portfolio as part of a long-term investment plan. We’ll look at well-constructed portfolios in a bit. For now, let’s continue on with the historical perspective of declining market trends.

Market Corrections

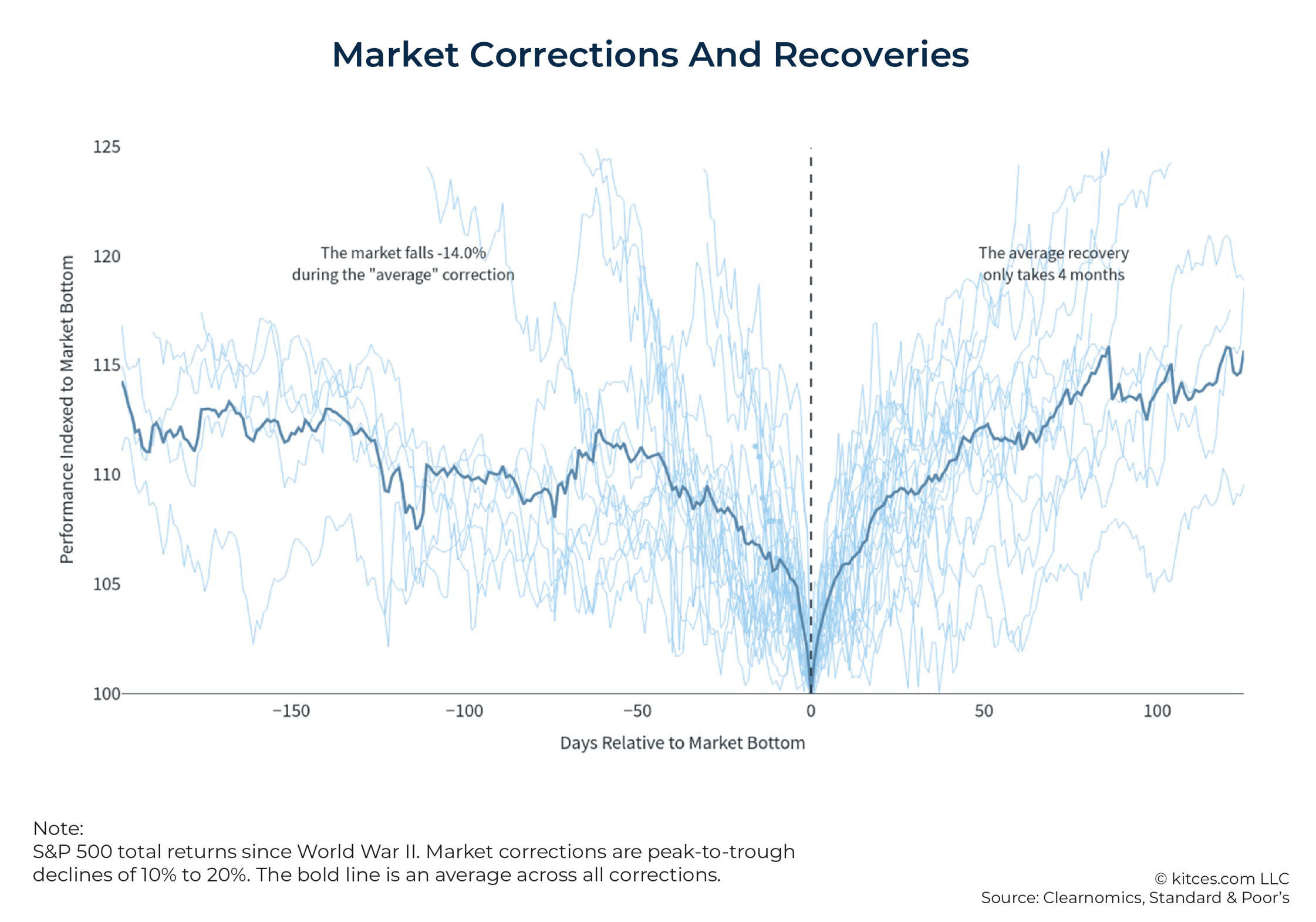

According to a kitces.com2 graphic shown below, market ‘corrections’ (at least a 10% downturn) are common with the average correction being about 14.1% and the average recovery period about 4 months. Periodic market corrections should be expected and accounted for in your long-term portfolio projections.

If you are in the market (vs timing the market), the correction periods should come and go without too much heartburn.

Please note that past performance and recovery periods are not guarantees of future performance or recovery periods.

Bear Markets

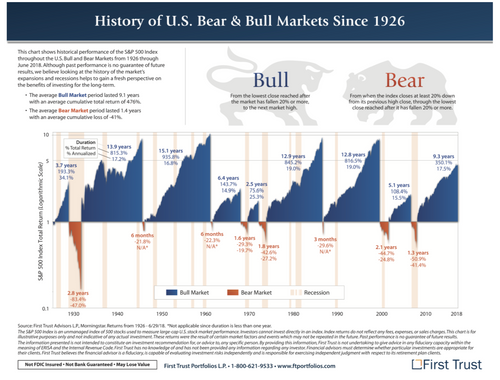

Bear markets (losses of 20% or more) are less common than market corrections, but obviously of great concern. It is not wise to withdraw from investment accounts when they are performing poorly, so this hits near retirees and retirees especially hard. However, there is a track record of a strong recovery period, as the chart from First Trust3 below shows.

Even in recent substantial bear markets like we had in 2022 (-25%), 2008-9 (-50.9%), and 2000 (-44.7%), those years were followed by a substantial bull market.

If you’re in the market for the long-term, the good news is that recovery has been a benefit to those with patience.

If you are near or in retirement, the caution is to carefully evaluate any withdrawals during the down period. Doing so may impact your long-term projections and be difficult to recover from. I’ll discuss more about the risks and potential ways to mitigate with my retirement investment philosophy in the next section.

As always, please note that past performance and recovery periods are not guarantees of future performance or recovery periods.

Our Retirement Investment Planning Approach

We’ve now reviewed the charts on market timing, corrections, and bear markets. And we’ve all heard the recommendation of “stay the course.” As a Financial Planner and a Retirement Planner, I subscribe to the “stay the course” notion, to some extent. However, there are a lot of caveats! Specifically for Retirement Planning, I subscribe to a few fundamental principles:

- Cover your essential expenses with an Income Plan

- Have a purpose and a game plan for your Investment Plan

- Understand your Risks

- Design a highly diversified, properly correlated, and low-cost portfolio

- Actively manage your Investment Plan

Income Plan

Before we start talking about an Investment Plan, l like to make sure that essential monthly expenses are covered by an Income strategy. Will Social Security, pensions, and other ‘guaranteed’ income streams cover your essential expenses? If not, it is my recommendation to consider using a portion of your investment portfolio to create a ‘retirement paycheck’ that can augment your other income sources to meet those essential monthly expenses. My belief is not losing sleep over how you will make ends meet will add to your overall well-being and health.

Converting a portion of a portfolio to an income stream may also help remove the angst of an up and down-market during retirement, provide more confidence in spending with an ‘income floor,’ and still preserve a portion of the portfolio for more aggressive long-term growth – for the longer-term objectives, such as Long-Term Care.

It is beyond the scope of this article to discuss all the income strategies available, but there are low-cost options available that could be deployed to help close the gap to meeting your monthly essential expenses.

You can read more about our Income Planning philosophy and services.

Purpose

Once we have the Income Plan in place to cover the essential expenses, I like to explore the purpose, goals, and objectives for the remainder of the portfolio. Investing, even when in retirement, should have a purpose and objective so that you know what target you’re shooting for.

Let’s say you are just starting your retirement, and your Income Plan is all set. Maybe you want to invest so that you can meet some goals within 5 or 10 years of retirement, such as pay off your existing home or purchase a vacation home. Maybe you have a goal to self-fund Long-Term Care in your later years. Those are all specific goals that can be modeled and projected for. Maybe some goals can be met, others need to be modified, or some that are just too much of a stretch.

By laying out a purpose with specific objectives, we can see what might be achievable. Today’s retirement planning software is powerful to make projections of multiple scenarios. Once you can see the best scenario(s) available for your specific situation, you are on your way to a Purposeful Retirement™.

You may chart your course toward a Purposeful Retirement™ starting with this reflective profile, reviewing with your loved ones and your financial advisor.

Risks

If you are near or in retirement, there are unique risk considerations. Sequence of Returns Risk (down markets within 5 years of retirement or in retirement) is a major risk that can play havoc with your retirement strategy and portfolio projections throughout your retirement time horizon – simply because your portfolio may not have enough time to recover.

Straight from a Kiplinger article found here: Sequence of Returns risk refers to the danger of experiencing poor investment returns early in retirement, which can significantly impact the longevity of a portfolio. Unlike average returns, this risk is tied to the *order* in which returns occur. If the market declines early in retirement while withdrawals are being made, the portfolio may shrink faster than expected, leaving less capital to recover during subsequent market upswings.4

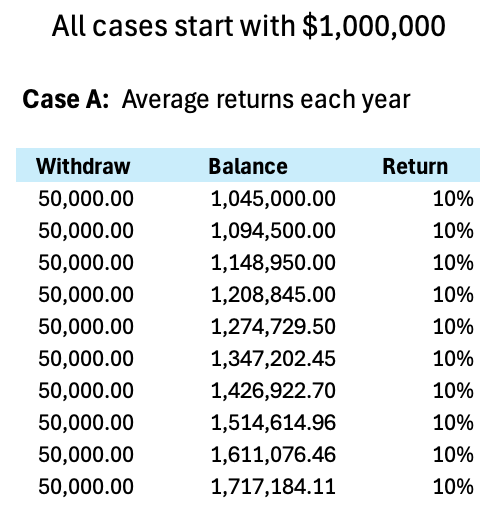

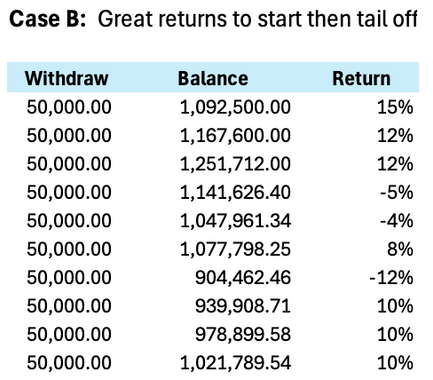

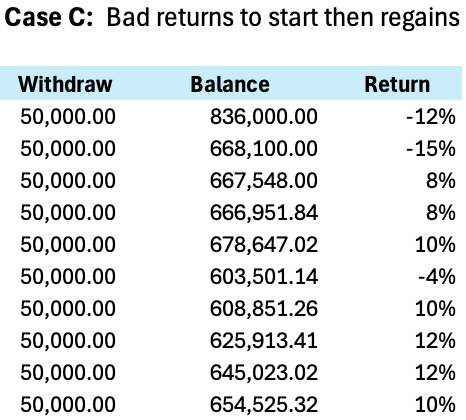

To show the potential impact of Sequence of Returns risk, here is an illustration comparing 3 different stock market return cases. Each case showing how the order of good and bad returns affects the bottom line after 10 years.

To show the potential impact of Sequence of Returns risk, here is an illustration comparing 3 different stock market return cases. Each case showing how the order of good and bad returns affects the bottom line after 10 years.

In each case, we start with $1,000,000 and withdraw $50,000 per year. All returns shown are for illustrative purposes.

In Case A, the return is a consistent 10% each year.

Case B front-loads positive returns in the early years.

Case C front-loads some negative returns in the early years.

The impact on the portfolio balance after 10 years is huge, ranging from $1.7m in Case A down to $654k Case C.

Source: Kastler Financial Planning | 2025 | All rights reserved

The bottom line is that Sequence of Returns affects the portfolio value during the retirement time horizon. Withdrawals during the early years during a down-market lock-in losses. These losses cause the investor to monitor their portfolio, consider adjustments to withdrawal amounts or risk running out of money too early. Reducing spending may impact the retirement lifestyle you were expecting.

This is where having a professional Retirement Plan can be most helpful. The underlying investment strategy may be designed to see you through the corrections and bear markets that we’re currently facing. If the portfolio is not designed to withstand the volatile swings, you may feel a bit unsettled.

Portfolio Design Considerations

My investment philosophy for the last 10 years has been to develop highly diversified and properly correlated portfolios, all at the lowest expense ratios possible.

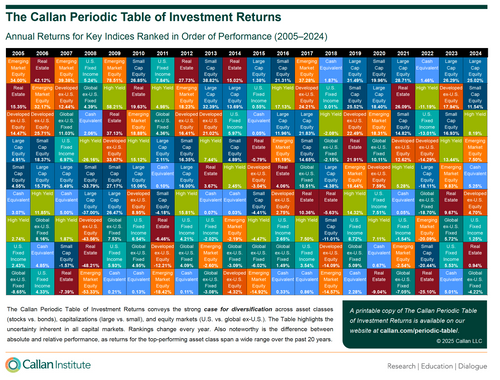

As one gets closer to retirement, it is more important than ever to have a diversified portfolio that is properly correlated, fits your Risk Tolerance profile, retirement goals and objectives. By ‘diversified,’ I do not mean the S&P 500, which is only one asset class consisting of only large U.S. stocks. Even the commonly referred to “60/40 portfolio” is only two asset classes: U.S. stocks and U.S. bonds.

A fully diversified, well correlated portfolio may consist of up to 7 to 9 different asset classes! Additional asset classes to consider are: Small Cap stocks, Real Estate, non-U.S. stocks and bonds, Fixed Income, High Yield bonds, cash and cash equivalents.

Callan Periodic Table

Multiple asset classes are important because not all asset classes perform the same each year. The Callan5 chart looks at 9 asset classes over a 20-year period. You can see that it is rare for a given asset class to repeat as a top performer 2 years in a row. For example, in the last 2 down markets (2018 and 2022) cash was indeed king of the hill. In 2017 both emerging markets and developed non-US markets did extremely well. It’s best not to miss out on the top-gainers by being invested in as many of the asset classes as possible.

The overall benefit of a multi-asset portfolio design is to help smooth out performance over time and especially during volatile times. Lowering the losses in a portfolio during the retirement years is a key objective.

Another portfolio design point is determining your Risk Tolerance to help determine how much risk you are comfortable with given your investing objectives, age, and goals. The RT score will help determine an appropriate asset mix for your portfolio and how much of your investable dollar amounts can be allocated into each of those various asset classes. It’s important to see if the risk in the portfolio lines up with your Risk Tolerance profile. Your advisor or portfolio software should have the capability to compare your personal risk tolerance to the portfolio risk.

For some people, a portfolio design consisting of large, somewhat stable companies that have a strong track record in dividend payouts, may be an alternative to help lower overall risk and provide monthly income.

Bucket Strategy

Another strategy common to Retirement Planning is to categorize investments into 3 buckets, commonly called a Bucket Strategy6. For Retirement Planning, a common example is:

Cash Bucket: 2-3 years of expenses into a readily available cash or cash equivalent account, such as a Money Market Fund.

Intermediate Bucket: 5-6 years of expenses invested in dividend or higher interest producing assets such as bonds, dividend stocks, or REITS.

Long-Term Bucket: All remaining investable assets would be placed in more aggressive funds since the bucket can better withstand the markets ups and downs with adequate time to recover. These assets would be targeted for long-term goals such as Long-Term Care.

The Bucket Strategy has some visibility benefits meaning that it is generally easier to visualize how much money is in each bucket and what it is targeted for – spending, income, or growth.

The downside, however, is it can be more difficult to manage, especially if one is a do-it-yourselfer with minimal experience. Knowing how, when, and how much to transfer between the buckets can be quite challenging.

To make it easier for the DIYer, or anyone for that matter, I generally choose a modification to the model. Here’s my approach:

- Design the portfolio based on Risk Tolerance, and use up to 7-9 asset classes

- Client develops their yearly expense requirements

- I put 2-3 years of spending dollars into the Cash Bucket (for example let’s say that’s 10%)

- I put the remaining 90% into the Investable Bucket (which is multi-asset so it consists of both the Intermediate Bucket and the Long-Term Bucket)

Yearly rebalancing will replenish the Cash Bucket and refresh the other assets back to the portfolio design.

Portfolio Management

My point in including Portfolio Management isn’t to say that portfolios should be actively managed in the sense of regular trading, timing market segments or ; they should not. However, a properly designed portfolio, should be reviewed at least yearly to determine if rebalancing is required – setting the asset mix back to the design point.

It’s also a good idea to review one’s risk tolerance periodically. Sometimes a life curveball may change how we feel about the investment risk we are willing to take.

Portfolio Management is not about ‘Timing the Market’ but about being wise during your ‘Time in the Market’. For those that commit to a plan and rebalance regularly, less anxiety awaits, and your long-term goals may come into focus.

How We Can Help

Our goal is to help you achieve your Purposeful RetirementTM. Income Planning, Tax Planning, and Investment Planning are the 3 key pillars to our 7 Pillars Retirement Planning® approach. Health, Long-Term Care, Risk Analysis, and Estate Planning round out the 7 pillars we can help you with to prepare your personalized retirement plan.

Mike Kastler has been performing financial planning and retirement planning since 2015. He has a Master of Science in Finance and the prestigious designation Retirement Income Certified Professional®. As a Fee-Only, Fiduciary, and Independent professional it is a client-first/planning-first approach. No commissionable products are sold and Assets Under Management (AUM) services are provided as a flat-fee service, not a % of AUM. More About Us here: KastlerFinancialPlanning.com/about

We Help You Visualize Your Retirement Possibilities

Citations

1. https://1818132.hs-sites.com/hs/home

2. https://www.kitces.com

3. https://www.ftportfolios.com/Index.aspx

4. https://www.kiplinger.com/retirement/sequence-of-return-risk-how-retirees-can-protect-themselves

5. https://www.callan.com/research/2024-classic-periodic-table/

6. https://www.investopedia.com/articles/financial-advisors/060815/comparison-bucket-strategy-vs-systematic-withdrawals.asp