Meet Kastler Financial Planning

Our Battle Cry: "Planning First!"

We believe a Planning First! approach will bring about the best possible solutions to help you achieve your best possible retirement

At Kastler Financial Planning (KFP), we believe that high-quality financial advice should be accessible without the pressure of commission-based product sales. As a fee-only financial planning firm, we provide personalized financial guidance without the conflict of interest that comes from earning commissions. Our "Planning First" approach and our fees are transparent and posted on our website.

We are a boutique firm, meaning we are small in terms of number of clients we serve. But we go 'long' in working on each client's specific needs to develop a personalized Retirement Plan. We put these words into action by encouraging every client to adopt their 7 Pillars Retirement Plan® profile, unique in the financial services industry. This helps us help you toward achieving your goals.

We are a boutique firm, meaning we are small in terms of number of clients we serve. But we go 'long' in working on each client's specific needs to develop a personalized Retirement Plan. We put these words into action by encouraging every client to adopt their 7 Pillars Retirement Plan® profile, unique in the financial services industry. This helps us help you toward achieving your goals.

Our Mission

Our mission is to ease your retirement anxieties by serving as your trusted guide toward a meaningful retirement with a personalized Retirement Plan, On-going support, and low-cost flat-fee portfolios.

Key Inspiration

Great businesses aren’t just measured in dollars. They’re measured in the lives they touch.

- Howard Schultz, former CEO Starbucks

- Howard Schultz, former CEO Starbucks

What's Unique About Kastler Financial Planning

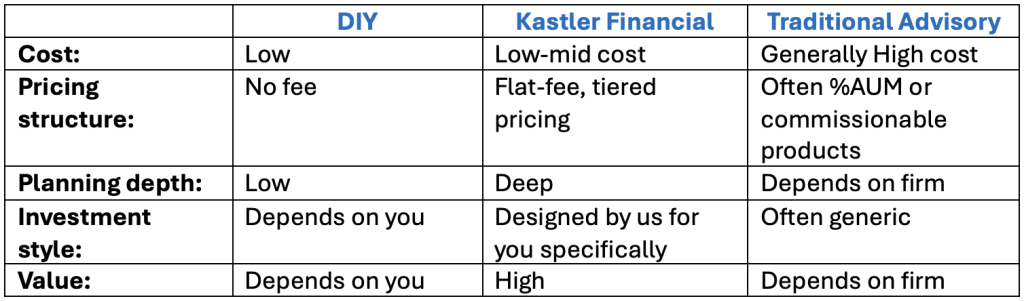

Most investors find two paths available for their Retirement Planning:

1. Do-It-Yourself platforms where you are responsible for figuring everything out yourself.

2. Traditional advisory firms offering investment management services often with %AUM fee structure. Some may offer planning services, others may not.

3. Financial planning firms that deliver a Financial Plan for a service fee. Some offer ongoing investment management, others may not.

1. Do-It-Yourself platforms where you are responsible for figuring everything out yourself.

2. Traditional advisory firms offering investment management services often with %AUM fee structure. Some may offer planning services, others may not.

3. Financial planning firms that deliver a Financial Plan for a service fee. Some offer ongoing investment management, others may not.

Kastler Financial Planning falls into the 3rd category, but with a purpose-driven approach:

• Self help: We provide an eGuide and coaching along 7 life pillars to help you identify your values, steward your resources with wisdom, and build a legacy that goes beyond wealth - helping you define a meaningful retirement. You can download the eGuide from our Resource center.

Kastler Financial Planning is a botique firm, meaning we have a small number of clients with a passion for making your Plan successful. We provide regular contact throughout the planning process and throughout the ongoing support cycle. We are a fee-only firm that delivers clarity, intention, and impact without commissionable products or generic advice.

Comparing 3 paths available

We are the new 3rd option, sitting in the middle of DIY (low-cost) and traditional advisory firms (high-cost) — not just in pricing, but in philosophy and service value.

• Self help: We provide an eGuide and coaching along 7 life pillars to help you identify your values, steward your resources with wisdom, and build a legacy that goes beyond wealth - helping you define a meaningful retirement. You can download the eGuide from our Resource center.

• Our Planning Service: 7 Pillars Retirement Planning® services uses leading edge financial software for 30-year analytical projections, yielding in our Purpose-Driven Portfolios™ and a Purpose-Driven Income Plan™designed specifically for you.

• On-Going Support: We go beyond the "quarterly investment statement" that everyone receives in the mail. We believe on-going stewardship of your Plan is essential to your long-term success. Our Financial Stewardship Support™ provides the extra care you need for implementation and oversight of your Plan.

• On-Going Support: We go beyond the "quarterly investment statement" that everyone receives in the mail. We believe on-going stewardship of your Plan is essential to your long-term success. Our Financial Stewardship Support™ provides the extra care you need for implementation and oversight of your Plan.

Kastler Financial Planning is a botique firm, meaning we have a small number of clients with a passion for making your Plan successful. We provide regular contact throughout the planning process and throughout the ongoing support cycle. We are a fee-only firm that delivers clarity, intention, and impact without commissionable products or generic advice.

Comparing 3 paths available

We are the new 3rd option, sitting in the middle of DIY (low-cost) and traditional advisory firms (high-cost) — not just in pricing, but in philosophy and service value.

Our Fiduciary Commitment to You

As a fiduciary, we are legally and ethically bound to act in your best interest - always. These two videos highlight how we built and 3 ways we serve clients differently.

A message from Mike: "We're Built Differently"

2-min video

3 Ways We Serve Clients Differently

1. Fee-only: Financial advice without the pressure or bias of commissionable product sales

2. Fiducary: To always act in your best interest before our own

3. Independent: Does not represent a brokerage firm or insurance company

2. Fiducary: To always act in your best interest before our own

3. Independent: Does not represent a brokerage firm or insurance company

Commitment to Our Community

In 2018, the Clarkston Independence District Library (CIDL) opened its Business Center. Unique to libraries, the business center vision was to bring business and community together with a small conference room for meetings and presentations with state of the art technology. KFP happily sponsored and donated the touch-screen TV which I still use today for meetings and small group seminars. Here are a few pics starting with the grand opening event (left)...

Schedule a Consultation

Contact Us TodayThere is no-cost and no-obligation to schedule your first 30 minutes to review your situation, discuss your goals, ask us questions, and determine if we're a mutually good fit.