Our eGuides, Spreadsheets, and eBooks can help ignite your preparation for retirement

KFP Resources Available

All eGuides, spreadsheets, and eBooks are offered "as-is" without warranties or guarantees. Not intended to provide financial advice. Please see a professional Advisor, Tax Consultant, or other licensed financial professional for specific advice. Spreadsheets require latest version of Microsoft Excel.

eGuides

7 Pillars Retirement Planning® eGuide

Helping you to retire with more clarity:

A faith-driven eGuide for a retirement of vision, purpose, and legacy

A faith-driven eGuide for a retirement of vision, purpose, and legacy

- History of Retirement in the U.S.

- Biblical Perspective on "Old Age"

- Exploring your Spiritual Gifts and Natural Abilities

- Crafting your Purposeful Retirement™

Get the Guide- Biblical Perspective on "Old Age"

- Exploring your Spiritual Gifts and Natural Abilities

- Crafting your Purposeful Retirement™

7 Pillars for Young Couples™

Helping you start with more clarity:

An eGuide for a beginning of commitment, vision, and balance

An eGuide for a beginning of commitment, vision, and balance

- What are the 7 Pillars?

- Reflective Questions for Each Pillar

- Tools and Resources

Get the Guide- Reflective Questions for Each Pillar

- Tools and Resources

Financial Spreadsheets

Kastler Financial Planning offers no-charge spreadsheets in Microsoft Excel format to help you get a better grasp of your current financial situation. For advanced planning tools and capabilities, see our Start My Plan page.

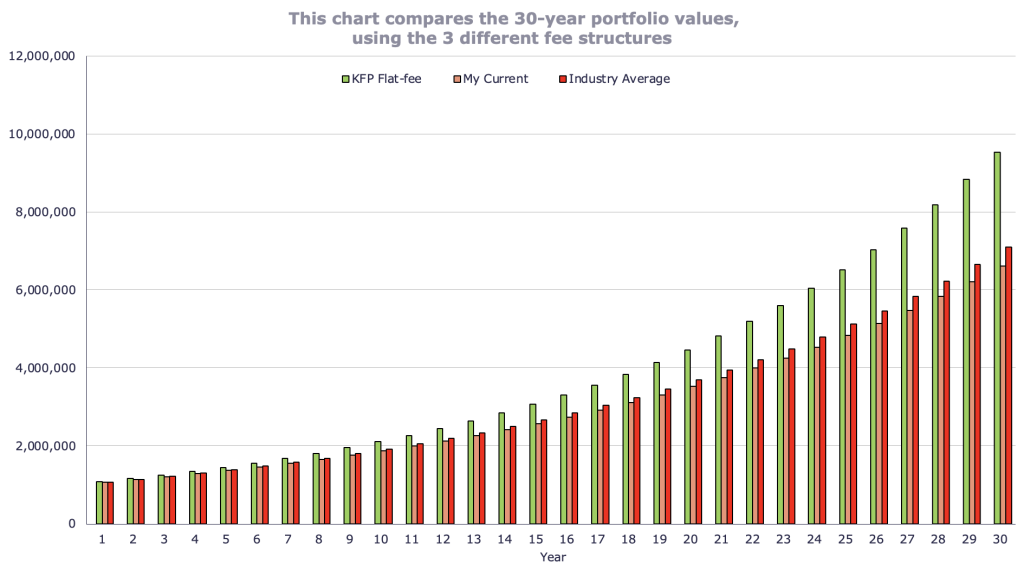

Advisory Fee Compare

Compare the impact of 3 different advisor fee schedules on a 30 year investment: Flat-fee, Industry Average, and Your Current.

Sequence of Returns

Set your portfolio value and yearly withdrawal. Compare 3 cases of stock market returns over 10 years.

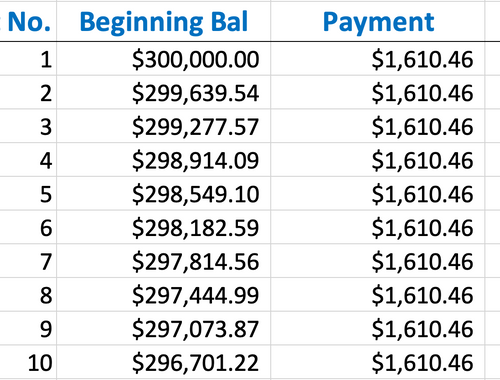

Loan Amortization

Evaluate a loan proposal from your lending organization. See total payments and breakdown of each payments P&I.

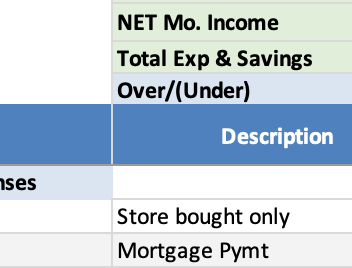

Cash Flow Planning

Organize your expenses into categories of Essential and Discretionary. Track your monthly Cash Flow.

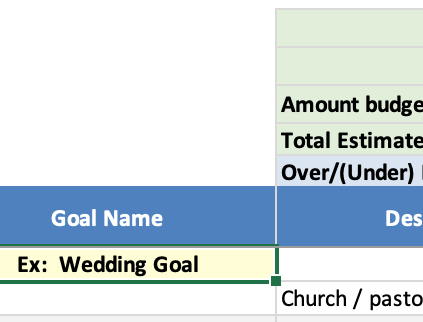

Plan a Specific Goal

Plan for a specific goal such as an upcoming wedding. Track your cumulative spending to reach goal.

eBooks

Women and Retirement

“The average lifespan is about

5 years longer for women than

men in the U.S., and about 7

years longer worldwide.”

- HARVARD MEDICAL SCHOOL

- HARVARD MEDICAL SCHOOL

One’s retirement strategy is an important part of holistic financial

wellness, yet it can present a unique set of considerations for

women. While the fundamentals of saving, investing, and

retirement strategy are universal, women may face distinct

factors that can impact their retirement roadmap.

Successful Aging

What a great time in life to spend doing what you’ve always wanted to do. Successful retirees have found that a successful retirement isn’t always about how much money they have, but the quality of life they are living.

Our special PDF workbook “Successful Aging” can help you reflect on what you would like to DO in retirement and give you tighter control and peace of mind with where you are at in life.

Please fill out the form below and request "Successful Aging."

Blended Families

Our complimentary PDF Blended Family Finances Workbook can help you get a feel for your blended finances for you and your spouse or soon-to-be spouse.

This is an opportunity for both of you to discuss family values, money values, and financial goals. Getting on the same page can be tough. We provide some guidance to help you through it.

Please fill out the form below and request "Blended Family.

DIY Planning

If you are 55+ and seriously considering your retirement, then this practical guide can help you better understand what's involved with the de-accumulation side of Retirement Planning. It is somewhat technical and especially appropriate for the engineering-minded, technical professional or the do-it-yourselfer.

This paper provides you with the steps involved to engineer your retirement plan, including sections on Research, Planning, Analyzing, Optimizing, Stress-Testing, and Release. All the engineering steps you would expect for a successful project. If you have an engineering type of mindset, I think you will appreciate this engineering approach to developing your Retirement Plan.

Please fill out the form below and request "DIY Workbook."

Request Form

Schedule a Consultation

Contact Us TodayIf you believe you could benefit from working with a financial professional, let’s review yours goals to see if you’re a good match for our practice.