Always Know The Service We Are Performing and the Cost

7 Pillars Retirement Planning®

The 7 Pillars that Make up a Broad-based Retirement Plan

1. Income Planning

2. Investment Planning

3. Tax Planning

4. Risk Analysis

5. Health Care

6. Long-Term Care

7. Estate and Legacy Planning

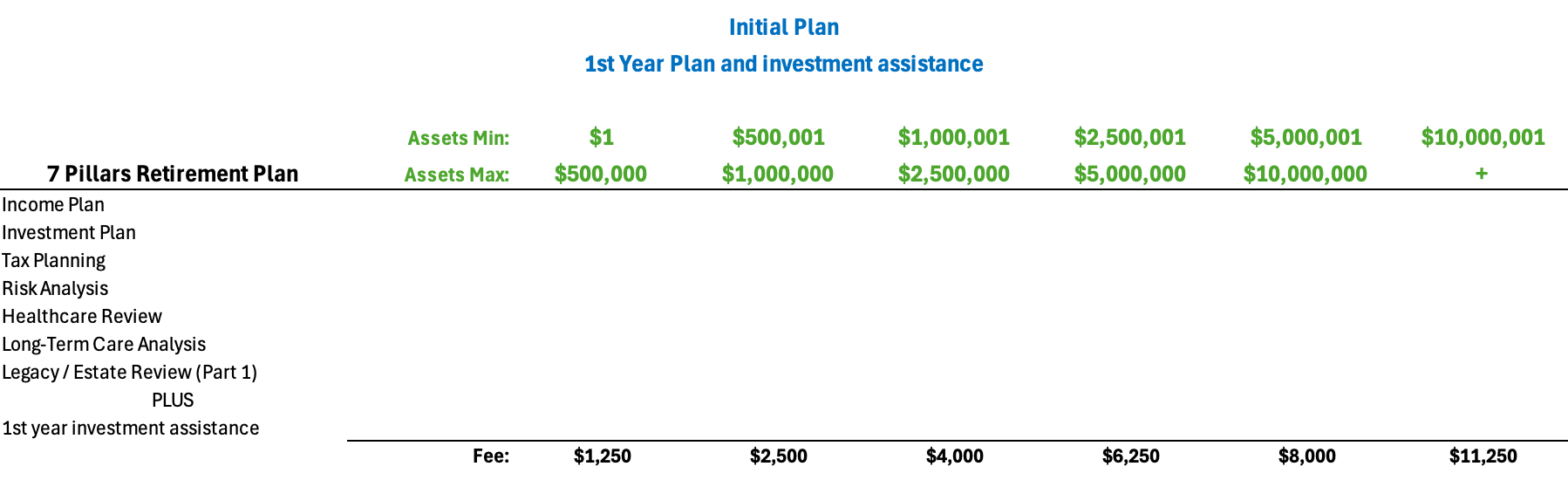

Tiered Pricing Schedule

Individual Pillar Description

Income Planning

We work with you to create an Income Plan that is in your best interest. Both guaranteed income and portfolio withdrawal considerations are analyzed to meet your monthly retirement expense needs.

We will look at where you are at today financially and what a retirement income plan would look like under your existing financial scenario. We’ll look at your current lifestyle expenses and compare to your expected retirement spending, the 'guaranteed' income(s) you are expecting, and any income/expense gap that may exist.

Income PlanningYou will also link your investment accounts to our software to analyze the possible withdrawal strategies, project how long the portfolio would last, run an analytic simulator, and calculate the probability of success. We will also have a collaborative planning session with you to run multiple scenarios. More info here:

Investment Planning

We'll design a low-cost investment portfolio to meet your needs, goals, and Risk Tolerance. We use a variety of Mutual Funds, ETFs, Index Funds, available on custodial platforms such as Schwab and Vanguard.

We will evaluate your needs, goals, Risk Tolerance, and then design a low-cost portfolio that matches your Risk Tolerance profile and meets your investment goals.

Investment PlanningYour portfolio will be designed using Modern Portfolio Theory (MPT) which is a highly diversified and a well-correlated set of funds. Our design is intended to be for long-term investing and does not include highly speculative investment types. More here:

Tax Planning

Are Roth Conversions are good for you and what the impact is on your 30+ year retirement timeline? If so, we'll be able to guide you on how much and when.

For some clients, tax planning can be a huge benefit in retirement, especially before your Required Minimum Distributions (RMDs) start to kick in, starting as early as age 73, depending on your current age. During the time between when you retire and when you start RMDs may be a good time to perform Roth Conversions to minimize your overall multi-year tax burden and also create a tax-free portfolio (generally, preferred over tax-deferred).

Tax PlanningWith our software tools, we can show you the long-term impact of your tax burden under different portfolio scenarios. More here:

Risk Analysis

Do you have the appropriate amount of life insurance? Is it even required? What is the financial risk if one spouse dies? Does your retirement have other financial risks?

We will help you right-size your emergency fund, review risk mitigation strategies such as life insurance should one spouse pass away.

Additionally, and pertinent to Retirement Planning, we will analyze other retirement risk factors such as:

-Sequence of Returns risk

-Inflation risk

-Longevity risk

-Social Security risk

Health

We’ll help you look at the various alternatives for LTC including insurance, hybrid life, and self-funding.

Commonly overlooked is what type of healthcare plan will be best for you. At age 65, everyone qualifies for Medicare Part A. What about Part B and D? Did you know there’s a Part C (Medicare Advantage) that is operated by private insurance companies much like an HMO. It’s usually cheaper than original Medicare, but may not be the best for you.

Original Medicare (Parts A, B, D, and various gap plans) may be more expensive, but offer more medical options with less deductibles. How will you determine which Plan is best for you? Too many commercials, headlines, and telesales agents? We can help sort through all of that and get the best Plan for you. (Fee for the consultation does not include the Medicare Plan)

Long-Term Care

We’ll help you look at the various alternatives for LTC including insurance, hybrid life, and self-funding.

For some clients, the cost of Long-Term Care (LTC) can be devastating. We can show you the impact on your retirement time horizon. Should you mitigate the risk with a LTC insurance policy, hybrid life insurance policy (life plus LTC rider), or self-fund LTC from your Investment Plan?

Estate and Legacy Planning

Everyone needs to have their estate planning documents in order. HNW individuals will need to go much further in tax planning and legacy planning.

Part 1: Estate: Review your existing estate planning documents such as existing Will, Trust, PoA, and medical PoA with some comments and recommendations to discuss with your Estate Planning Attorney.

Part 2: Legacy: Analyze wealth transfer options. If you are a High Net Worth (HNW) or Ultra HNW individual, you have many tax saving tools available to manage your legacy estate. We can help you understand CRATS, GRATS, SLATS, and ILITS and how they may be advantageous to you and your heirs.

Learn More!

Contact Us TodayIf you believe you could benefit from working with a financial professional, let’s review yours goals to see if you’re a good match for our practice or if you have any questions you can ask here!